PRODCAT RILA Intro

Is aligning traditional saving options with your objectives a challenge?

ForeStructured Growth is a registered index-linked annuity (RILA) that is designed to help gain control of your retirement savings strategy by balancing growth potential while limiting exposure to losses.

ForeStructured Growth RILA may help if you want to:

Gain Perspective.

An alternative to low-rate fixed income options and volatile market investments

Gain Potential.

Performance tracks an index, subject to maximum crediting and loss protection features. You are not invested directly in the index or stock market; however, values will fluctuate, including possible loss of principal.

Gain Control.

Tailor your strategy for meaningful growth potential while managing exposure to possible losses.

Gain perspective

The charts below show that equity markets have historically provided long-term growth opportunities. You can see that the S&P 500® and NASDAQ-100 Index® have delivered positive returns more than three-quarters of the time over both one-year daily rolling periods, and over six-year daily rolling periods, the S&P 500® Index performed even better.

With ForeStructured Growth RILA, index values at the beginning and end of the Strategy Term are used to determine interest crediting, regardless of what happens in between. So you can remain focused on the end result, not short-term volatility.

Source: SPX, NDX.

For illustrative purposes only. Past performance is no guarantee of future results. Historical index performance, chosen to illustrate how a one and six year period may perform, does not reflect performance of any Global Atlantic product including the ForeStructured Growth registered index-linked annuity which will be different. Index performance is historical, does not reflect the impact of reinvested dividends, costs or expenses typically associated with investing. Investors cannot invest directly in the index.

Gain control

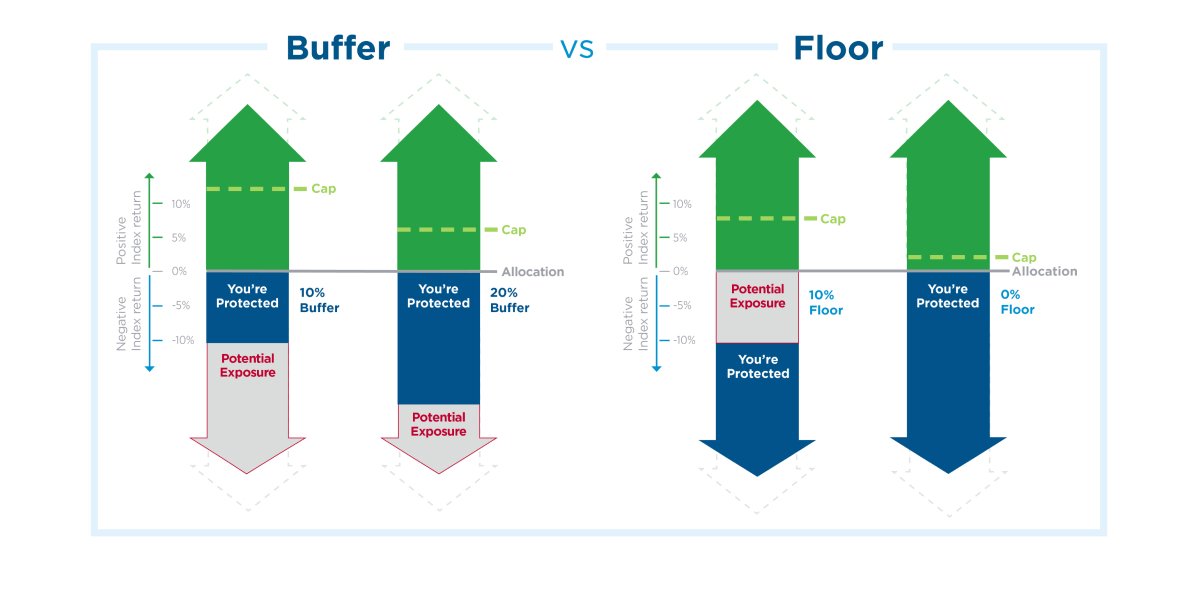

Index crediting strategies will use either a buffer or a floor designed to help reduce the risk of losses should index returns be negative.

- A buffer is designed to absorb a set percentage of downside, limiting your loss potential to amounts exceeding the buffer amount during each Strategy Term.

- A floor is designed to limit your potential losses to a set percentage during each Strategy Term.

- A cap sets the limit on how much the contract value can grow during each strategy term. Cap rates are declared in advance of the strategy term and are guaranteed for the entire strategy term, but may change for future strategy terms. Cap levels vary by strategy and are subject to change.

- A participation rate is the percentage of the index return that is credited for the Strategy Term. Participation rates are declared in advance of the strategy term and are guaranteed for the entire strategy term, but may change for future strategy terms.

How's it work?

You can use this calculator to create hypothetical illustrations of up to four Index Crediting Strategies to see how ForeStructured Growth (RILA) Index Crediting Strategies are able to employ either a buffer, a traditional floor, or our exclusive Adaptive Floor1 Crediting Strategy— all of which are designed to help manage losses should the underlying index returns are negative.

Ready to add ForeStructured Growth to your retirement strategy?

Talk to your financial professional about ForeStructured Growth Registered Index-linked Annuity today.