A strategy designed to stretch income across multiple generations

The U.S. baby boom that peaked back in 1957 has now become the grandparent boom. There are more than 70 million grandparents in the U.S.-- which means about one-third of all adults in the U.S. are a grandparent.1

Today’s grandparents both control and gift a significant amount of wealth:

- They hold about one third of the nation's assets.2

- Americans aged 55-64 (mostly grandparents) have the highest net worth of any age group.2

- Grandparents give their grandchildren over $5 billion yearly in stocks and other financial securities.2

Leaving a lump sum inheritance to your heirs is an option. You may also consider using an annuity to create a legacy of income that may span generations.

Using a single premium immediate annuity to create multigenerational income

A multigenerational income strategy using a single premium immediate annuity (SPIA) is designed to create a stream of protected income for the rest of your life, and potentially the lives of your children, grandchildren and beyond.

You receive the benefit of protected income during your lifetime with the ability to pass these income payments to the next generations as a lasting reminder of your legacy.

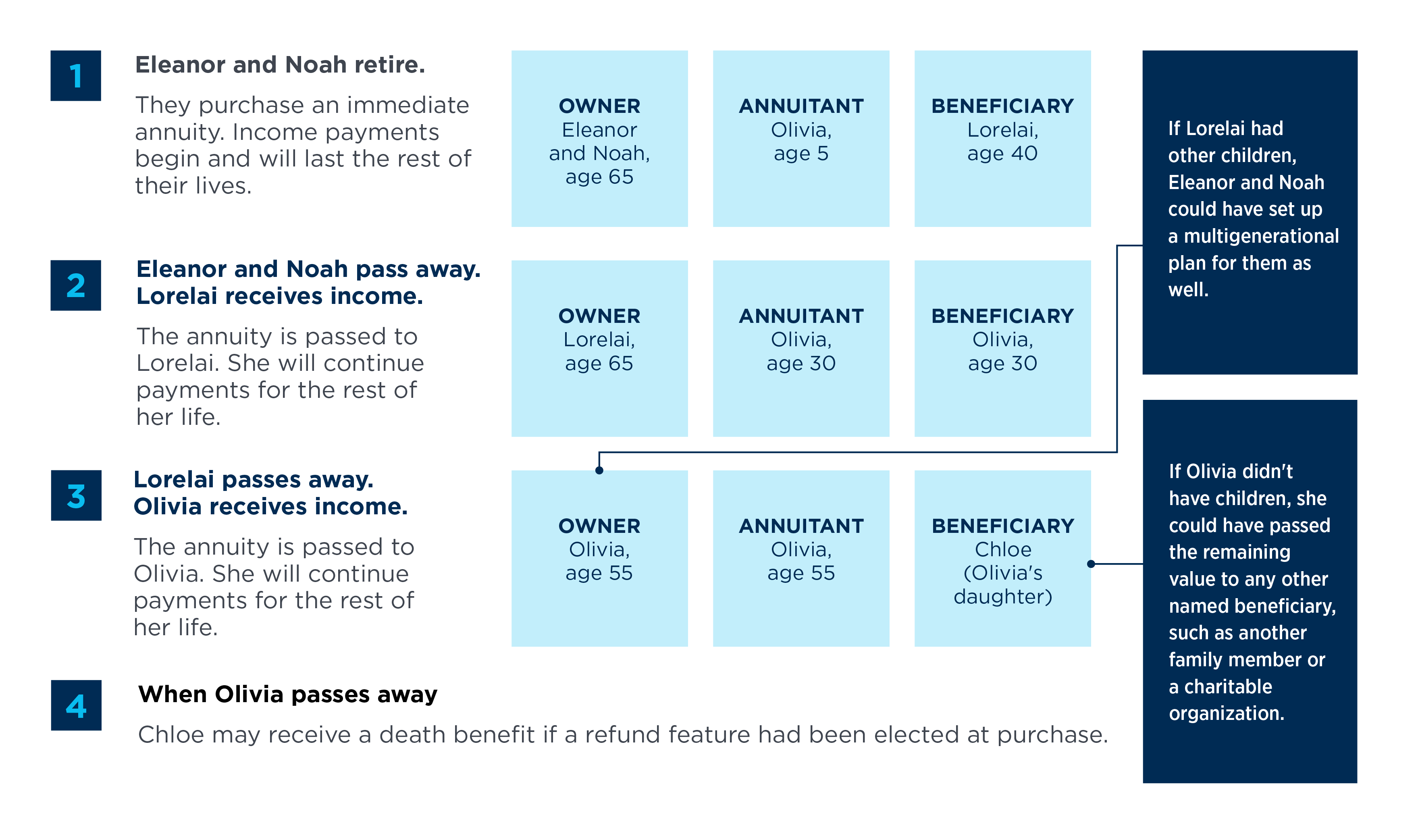

A hypothetical case study

Eleanor and Noah, ages 65

Lorelai, daughter, age 40

Olivia, granddaughter, age 5

Eleanor and Noah purchase a single premium immediate annuity (SPIA) using nonqualified money. They can select life only, life with period certain or life with cash refund. They title the contract as follows:

FOR ILLUSTRATIVE PURPOSES ONLY. Actual results may vary. This strategy may not be appropriate for all situations and circumstances. Stretching retirement assets over generations is not a feature of an annuity; it is a strategy for which a non-qualified annuity is one product that may be used. This strategy may be appropriate if you do not need to maximize current income from your annuity. Also keep in mind that tax consequences may impact this strategy. See your tax professional for guidance about your specific tax situation.

In this example, the SPIA created a living legacy by stretching the income stream across multiple generations. To learn more about this strategy that may help you transfer wealth through an income stream to future generations, talk to your financial professional or tax advisor.

Share

Related resources

More on Advanced Markets

Your Thriving

Practice

A destination to empower financial professionals to build, manage, and grow their practice

Get started with Global Atlantic

Take the next step with a company that can help elevate your business.

Need help?

Find all the contact information to submit and service your business.