The number of single women is increasing. So is their wealth.

Women are increasing their wealth faster than ever before, adding $5 trillion annually to the global wealth pool and outpacing the overall growth of the wealth market.5 In North America, women hold the largest share of wealth at 37% relative to the total regional wealth pool, and the greatest volume of assets in absolute numbers at $35 trillion.5

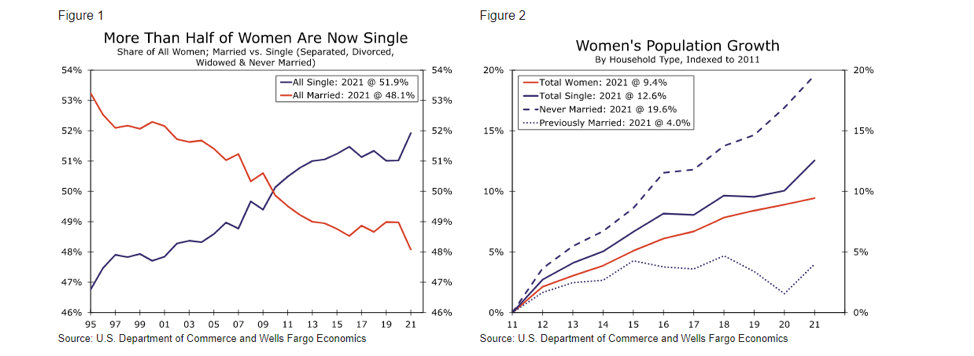

Additionally, more women are choosing to remain single, and with that are achieving greater equality in areas like education, career advancement, homeownership, and consumer power. Clearly, this market presents a large opportunity for financial professionals.

Cultural shifts

“You need to be able to communicate your brand to others clearly and simply.”

Relationships, living arrangements, and family life have evolved over the past several decades, leading to an increase in the population of all single, working-age American adults.1 A growing number of women are also putting off motherhood or skipping it completely. In the United States, birthrates have steadily declined, and it’s projected that by 2030, 45% of women between the ages of 25 and 44 will be single and child-free.3

Consequently, many women are advancing further in their careers than previous generations and are entering a new era of wealth. Single women without children had an average of $65,000 in wealth in 2019, compared with $57,000 for single, child-free men.4 The lifestyle and financial freedoms that a well-paying job affords are often big incentives for women seeking to move ahead in their careers.

The unique needs of female clients

For women, children remain one of the most important considerations when it comes to their wealth. Indeed, motherhood is one of the biggest contributors to the gender wage gap, since working mothers often choose to work fewer hours or stop working altogether.3 Financial professionals should be prepared to address this topic with clients who are or who are thinking about becoming parents.

Nancy Nawn, managing partner and financial planner at WatchDog Planning, adds that marriage and motherhood can easily become burdens if a woman isn’t financially prepared for them, whether she’s single and saving, married, or facing a divorce. “It’s really tough when a woman is a stay-at-home wife and then the marriage fails. After divorce, she’s at a significant disadvantage because she often has no earning power or a history of work experience,” says Nawn.

Despite the shift in household structures and increased labor participation rates, never-married men typically still earn more than never-married women.6 This means single women tend to spend a higher share of their earnings on necessities like housing, healthcare, education, and food away from home, something financial professionals should be aware of when working with this demographic.6

Long-term financial factors are also unique for single women. “I was single for a very long time, and I can say it’s a lot different for single women,” says Nawn. “We have a lot of obstacles in front of us. We live longer, we have higher healthcare costs, we need time off to have a baby, and we also tend to be family caregivers.”

Leveraging higher education and real estate assets

In the United States, women are earning college degrees at higher rates than men, becoming the primary breadwinner in nearly 30% of married households and nearly 40% of total households.3 Millennial women are the most highly educated generation to date, with almost half of employed millennial women having a bachelor’s degree or more.7 Women also contribute more to household incomes than women of previous generations, and as such control a larger share of the U.S. consumer market, at an estimated $7 trillion.3

Women are also outpacing men in homeownership. In 2019, real estate made up 40% of the assets of single, child-free women—more than the 33% share for men.6 According to research from the National Association of Realtors, single women are often more willing than men to make financial sacrifices in order to buy a home, such as cutting spending on nonessential goods, entertainment, and travel.

"Single women without children had an average of $65,000 in wealth in 2019, compared with $57,000 for single, child-free men4."

Retirement and healthcare

In spite of challenges to building wealth, retirement preparedness among single women has drastically improved, proving that the movement away from marriage doesn’t have to carry a steep retirement penalty as it once did. However as a whole, single women are putting less money toward pensions and insurance, which may suggest less saving and further highlighting their potential financial fragility.6 Like men, the largest expense for women as they age is healthcare. But because women generally live longer than men, it’s important to consider how healthcare expenditures in the long term might affect their wealth.

Breaking through to the next generation of female investors

For many women, financial decisions are about more than the bottom line. According to Nawn, long-term financial planning for women looks a lot different because of their unique life circumstances. Unlike men, women tend to invest to fund specific goals, such as leaving a legacy for the next generation, supporting a post-retirement lifestyle, endowing a family business, or making a social impact in their community.5 “A woman often has so many roles, and even now, women need to protect themselves and earn a living because relationships don’t always last and often are interrupted by divorce, death, or an illness. If you’re not able to support yourself as a woman, you put yourself in a vulnerable situation,” says Nawn.

Many financial institutions still rely on broad generalizations when it comes to working with female clients, which can result in products, services, and messaging that feel superficial, out of touch, or even condescending. Many financial institutions are catering more to female clients, but many still treat women as a homogenous group rather than a diverse client base with unique needs and goals.5

Financial professionals can better serve single women by doing the following:

- Confronting their own unconscious biases: Financial professionals can tackle gender-related bias through awareness, training, and creating diversity goals that support and provide resources for their female clients.

- Empowering women by leveraging their referral network: Financial professionals can empower women and create value by leveraging their referral network, which may include CPAs, attorneys, and other professionals who can address their clients’ diverse needs.

- Personalizing their approach: By tailoring their approach, financial professionals can help women manage their financial planning priorities and design a portfolio that is more closely aligned with those priorities – whether that be higher education, real estate, motherhood, or long-term care planning.

Financial professionals can start by recognizing single women as an enormous opportunity and make the 2020s a defining decade for women’s wealth.

Share

Related resources

More on Expert Insights

Your Thriving

Practice

A destination to empower financial professionals to build, manage, and grow their practice

Get started with Global Atlantic

Take the next step with a company that can help elevate your business.

Need help?

Find all the contact information to submit and service your business.