Understanding changing demographics brings increased opportunities

Changes in U.S. demographics are providing both challenges and opportunities for financial professionals as they look to diversify their client base. Two growing—and often misunderstood—groups that many producers are currently targeting are Latinos and Asian Americans.1 This series is intended to dispel some myths and help familiarize producers with the overall financial goals, needs, and practices of these two groups.

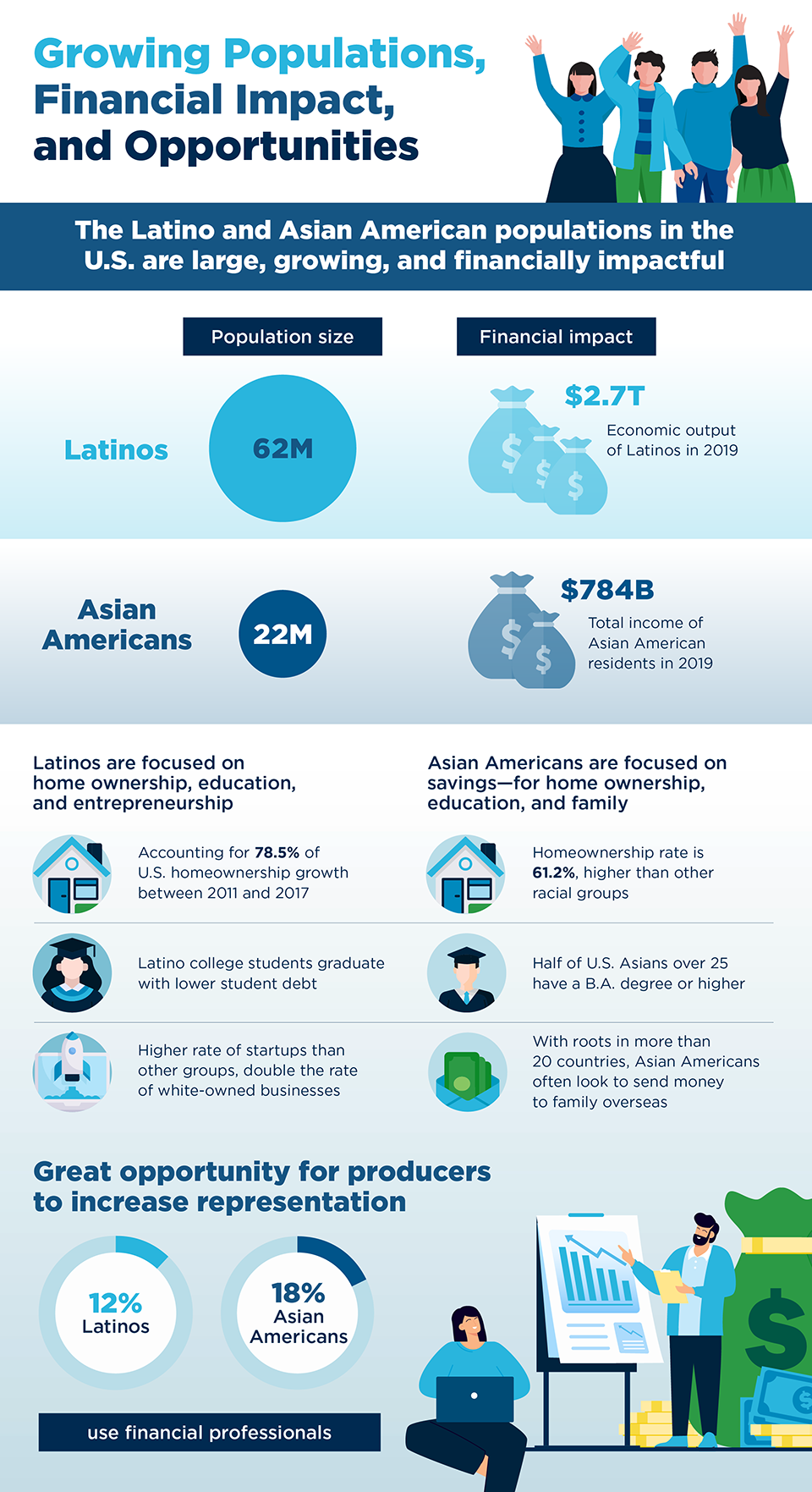

The 62 million Latinos currently living in the U.S. make up the nation’s most populous minority (18.7 percent of the U.S. population)2, while 22 million Asian Americans make up 6 percent of the population.3 The Pew Research Center estimates that by 2060, the Asian American population will top 46 million.

The financial impact these groups are having is also impressive. According to the 2021 U.S. Latino GDP report from California-based Latino Donor Collaborative, the total economic output of U.S. Latinos in 2019 was $2.7 trillion, up nearly 9 percent from 2017.4 Research from the Washington, D.C.-based New American Economy Research Fund shows that in 2019, Asian American households earned more than $783.7 billion in income, giving them $543.4 billion in spending power after taxes.5

Latinos, for their part, according to McKinsey & Company, start more businesses than any other racial or ethnic group in the U.S.6, and, according to the National Association of Hispanic Real Estate Professionals, were the first demographic group to increase their rate of homeownership after the Great Recession.7

Yet, in many ways, such sources as McKinsey and Yale University8 indicate that, for both groups, this apparent financial strength and upward trajectory is weaker and flatter than it seems and significantly underperforms when it comes to wealth accumulation

Looking to boost wealth building

There are also long-established cultural practices regarding money and investing, and these have proven to be difficult to change.

“Closing the gap to improve and boost wealth-building for Latinos, Asian Americans, and other minority groups starts with education,” says John Knisley, a financial planner with the Ithaca, New York-based wealth management firm Tompkins Financial Advisors. To address this issue, Knisley’s firm has launched a Diversity, Inclusion, and Belonging (DIB) initiative, which provides underserved communities with financial tools and resources, starting in grade school, and then works with clients to “show them where the blind spots are, simplify the jargon, explain the terminology, and most importantly, not push products, but present [clients] with sound solutions that match and support their priorities.”

These markets, currently underserved by financial professionals, are ripe with opportunity. While diversity among Certified Financial Planners (CFPs) is improving, Barron’s reported that in 2020 there were only 2,170 Hispanic CFP® professionals, or 2.5 percent of all holders nationally.9 In terms of seeking guidance, only 18 percent of Asian Americans currently work with a financial professional10, compared to 38 percent of the general population.11 That percentage is even lower for Latinos, where only 12 percent use financial professionals.12

While some may be concerned that Latinos and Asian Americans may have reservations about working with financial professional from other backgrounds, it turns out that’s not at all the case—which the next two installments in this series—one on Latinos and one on Asian Americans, will demonstrate. What is abundantly clear is that if you start by building trust, demonstrate that you understand different financial behaviors and priorities, and successfully navigate cultural nuances, there are boundless opportunities to unlock in the multicultural market.

In subsequent articles, we’ll look more closely at the Latino and Asian American markets and will explore the specific opportunities these groups present for financial professionals.

Share

Related resources

More on Multicultural Markets

Your Thriving

Practice

A destination to empower financial professionals to build, manage, and grow their practice

Get started with Global Atlantic

Take the next step with a company that can help elevate your business.

Need help?

Find all the contact information to submit and service your business.