How 1040 tax forms can spark better discussions with your clients

Have you ever reviewed your clients’ 1040 tax return forms with them? While you may not be giving them tax advice, talking through these crucial documents may open avenues to discuss the benefits of tax deferred growth and guaranteed lifetime income with an annuity.

Below, we’ve annotated a 1040 tax return form to pinpoint several areas that can serve as good conversation starters — for discussions about everything from charitable giving to IRA and pension distributions.

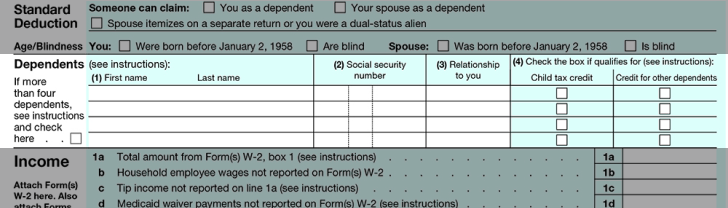

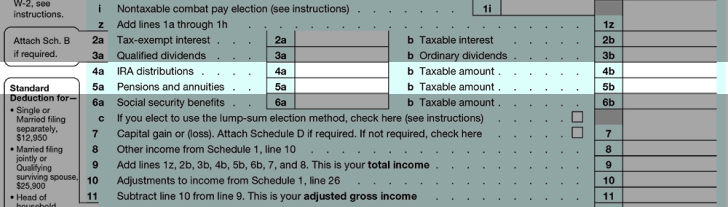

Form 1040

Dependents

Conversation starter: Are you saving for college for your dependents? Have you started a 529 Plan? If a 529 has been established and is not needed, would you consider transferring a portion of the 529 into a Roth IRA (available starting in 2024)?

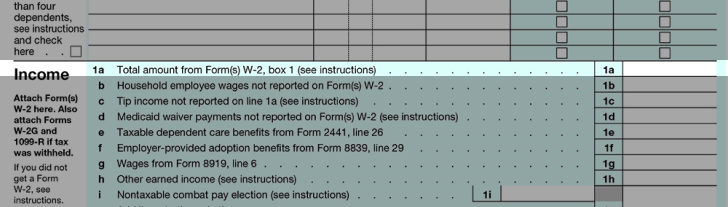

Form 1040

Line 1a: Total amount from W-2

Conversation starter: Are you contributing to a 401(k) or other qualified plan? Would you like to consider additional investments for retirement that also offer tax deferral? Are you seeking more investment choices and product features, such as insurance guarantees, that your plan does not offer?

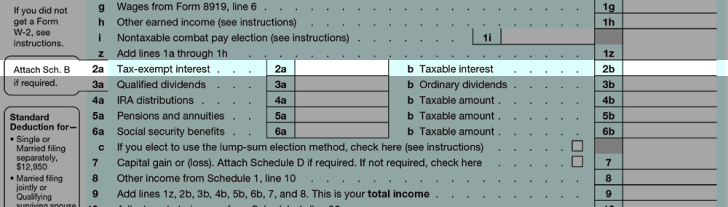

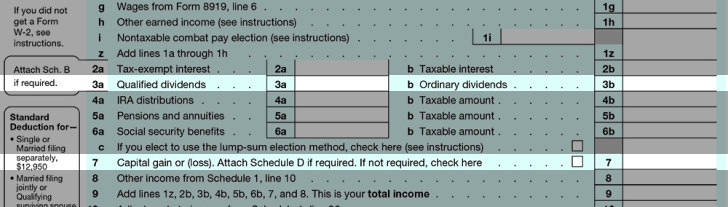

Form 1040

Lines 2a, 2b: Interest Income

Potential sources: taxable savings accounts and certificates of deposit

Conversation starter: Do you need all of this interest income for your living expenses? Is the account that’s generating this income earmarked for retirement? Have you considered ways to defer taxes on some of this money? Would you consider other products with more growth potential that still provide security?

Form 1040

Lines 3a, 3b, 7: Dividend income and capital gains

Potential sources: stocks, mutual funds

Conversation starter: Do you need all of this dividend income for your living expenses? Would you consider a product that provides tax deferral, while still offering growth potential?

Form 1040

Lines 4a, 4b, 5a, 5b: IRA and pension distributions

Potential sources: IRAs, pensions and annuities

Conversation starter: Who is your IRA provider? What are your IRA assets invested in? Have you thought about creating guaranteed lifetime income from your IRA account?

Are you taking RMDs from your IRA and don’t need the income for expenses? There are annuities that may allow you to defer taking RMDs from the money in that annuity until age 85, instead of age 73.

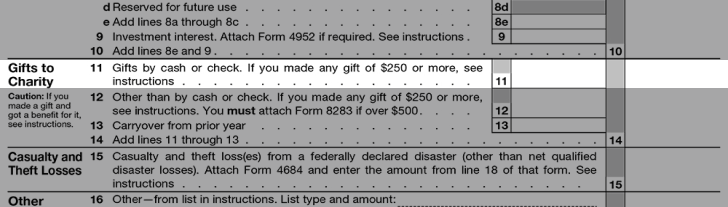

Form 1040 Schedule A

Line 11: Gifts to Charity

Conversation starter: Do you plan to continue donating to charities? If over age 70 1⁄2 years, have you considered making gifts directly from your IRA to the charity for potential tax benefits?

Share

More on Advanced Markets

Your Thriving

Practice

A destination to empower financial professionals to build, manage, and grow their practice

Get started with Global Atlantic

Take the next step with a company that can help elevate your business.

Need help?

Find all the contact information to submit and service your business.