As you’ll read in the following pages, two-thirds of Americans are financially illiterate1, with less than half of respondents to a recent survey able to answer four out of six basic financial questions.2 Today, less than a third of Americans say they’re happy with their financial situation3—a source of discontent that only increases as retirement approaches.

So, it may come as no surprise that nearly two decades ago, the National Foundation for Financial Education (NFFE) and the U.S. Senate designated April—the month when income taxes are due—as Financial Literacy Month. The increased attention that financial literacy has drawn since then has, in essence, turned this into a yearlong observance.

While NFFE’s initial goal was to help provide financial education to students, and while many have advocated making financial literacy a pre-requisite for high school graduation, the lack of financial literacy among adults, and the demonstrated positive impact that having financially literate clients can have on producers, makes championing financial literacy a priority for most producers and clients alike.

What qualifies as financial literacy?

61% of non-retired Americans know little or nothing about annuities and their role in a retirement plan.4 Chances are they are less than adequately informed about:

- Budgeting to match income with expenses

- Savings

- How bank accounts work

- Interest rates

- Time value of money

- Stocks, bonds, mutual funds, asset allocation/diversification, risk

- Retirement planning

- Borrowing

- Credit Scores

- Real estate investments

It’s all about confidence

Financial literacy is more than just the knowledge of basic financial concepts. It also includes the skills, motivation, and—most importantly—confidence needed to turn those concepts into sound financial decisions.

Financial professionals know that it can be hard to develop successful long-term relationships and to close sales—with clients who don’t fully understand basic financial concepts. This lack of knowledge often means they lack the confidence to build a plan and implement it.

“61% of non-retired Americans know little or nothing about annuities and their role in a retirement plan.”4

But the opposite is equally true. Having financial literacy gives clients the confidence to see you as their partner and use your guidance to move forward. If they understand the concepts, they’ll understand the solutions.

So, by providing your clients with the education they need to develop financial literacy, you’ll give them the confidence they need to do ongoing business with you. And confidence will have a domino effect of positive outcomes: Clients will understand more, which leads to better conversations, which leads to more trust and a more efficient process, which leads to faster decision-making.

The five pillars

These concepts form the foundation of financial literacy:

- Earn income from employment and other sources.

- Spend the income on basic needs and discretionary items.

- Save and invest to create cash reserves and build capital for the future. Key topics include asset allocation, banking, budgeting, diversification, growth, interest rates, retirement planning, and risk tolerance.

- Borrow money for large expenses such as a car, education, mortgage, or real estate. Key topics include compound interest, loan qualifications, the obligations of debt, payment schedules, and the time value of money.

- Protect health, income, property, retirement, and savings with insurance products.

Why financial literacy is important

How important is financial literacy? Consider these numbers:

- Living longer. According to United Nations data,5 the average American currently lives 79.1 years, up from 76.8 years in 2000. Life expectancy is projected to rise to 80.3 years in 2030 and 82.0 years in 2040. Translation: People will often need their assets to last longer, which highlights the necessity of careful retirement planning. [with graph showing growth]

- Financial dissatisfaction. Only 31% of Americans are satisfied with their financial condition.3

- Retirement anxiety. 83% of Americans are at least somewhat concerned that their savings won’t provide enough to support them in retirement.3

- No preparation. Just 41% of Americans have tried to figure out how much money they’ll need for retirement.4

- Stretched for cash. 30% of Americans can’t come up with $2,000 for an unexpected emergency within the next 30 days.2

They know they need it

In a recent financial literacy survey6:

Nearly two-thirds of respondents said that financial education should supplement math, English, and science as a high school graduation requirement, with the same percentage saying that the most important skill that kids need is money management—higher than healthy eating, exercise, safe driving, and even the dangers of drugs and alcohol.

More than half noted that, if they had the chance, they’d teach their younger selves to save money, manage money, and not only set financial goals but work toward them.

The vast majority cited the lack of financial literacy as a contributing factor to poverty, a lack of job opportunities, unemployment, and wealth inequality.

Still, financial literacy is alarmingly low

Even as the need for financial literacy is clear, numerous survey results show its existence is alarmingly low:

- According to the Financial Industry Regulatory Authority (FINRA), 66% of Americans are financially illiterate.1

- Half of respondents to the 2021 TIAA Institute-GFLEC Personal Finance Index2 correctly answered survey questions—meaning that half got the answers wrong.

- Only 40% of respondents could correctly answer four out of six basic financial questions. The number dropped to 34% when there were five questions.3

- By age 50, less than one-third of respondents could correctly answer three simple financial questions, while just 49% did so by age 70.7

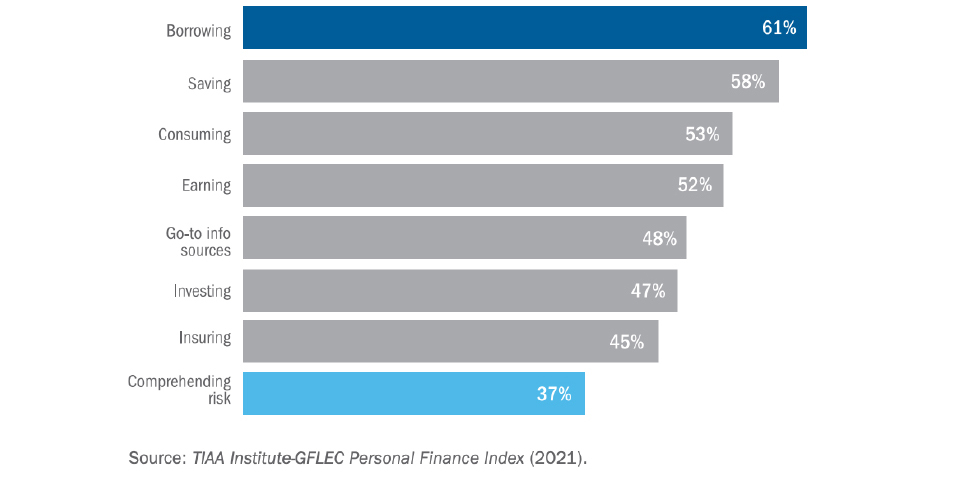

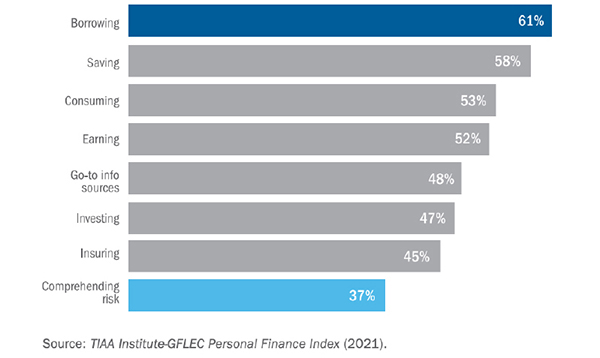

Percentage of assessment questions answered correctly

Over the course of five years, the TIAA Institute-GFLEC Personal Finance Index has consistently shown that while borrowing is understood by more than half of American adults, an appreciation for risk and uncertainty is shared by just over one-third.

Producers benefit from financial literacy

When clients are financially literate, producers are often big beneficiaries. Literacy helps clients understand what producers do, particularly with regard to managing assets, which leads clients to appreciate the relationship even more. It provides financial professionals an opportunity to demonstrate their value to clients—and thus should be part of the producer’s value proposition, since it typically positions financial professionals as first-call financial experts.

Producers who offer financial education can often get better client outcomes when the education is part of the client experience (e.g., via live group events or webinars). According to a Cerulli Associates study8, financial professionals who take an experience-centric approach to client relationships enjoy these advantages:

- Higher median client size. Experience-centric practices have a median client size of $1 million versus the $518,732 industry average—a 93% difference.

- Lower client attrition. Producers report that involuntary attrition (due to death, moving to another producer, transferring assets to an online provider) accounts for 26% of their asset outflows, much lower than 34% for the average practice.

- More-affluent clients. 40% of investors with more than $2 million in investable assets work with experience-centric practices, compared to 20% of investors with $100,000‒$500,000.

- More touchpoints. On average, experience-centric practices reach out to clients 11.6 times per year, twice as many as their peers. Educational events are a key touchpoint: Experience-centric practices hold an average of 6.4 such events annually—more than triple what their peers do.

Clients also benefit

An avalanche of academic studies has linked higher financial literacy to greater financial well-being—and vice versa. For starters, highly literate people are more likely to plan for retirement: Those who plan, arrive at retirement with 2‒3 times the amount of wealth compared to those who don’t plan9. Literacy is also associated with effective budgeting; better ability to handle emergency expenses and income shocks; successful management of credit cards, mortgages, and other forms of debt; superior management of expenses; and stronger investment performance. As a result, financially literate people tend to experience less financial stress and anxiety.

Getting started on the road to financial literacy

We’ve shown that financial literacy is important, is frighteningly low, and has numerous benefits for investors and financial professionals alike. Here is a sequence of key steps producers should take to educate their clients—and give them the confidence to make better, more-informed decisions.

- Know what financial literacy is. This seems like a no-brainer, but it isn’t. Financial professionals must be able to explain the general idea of financial literacy and be fluent in all of its subtopics.

- Qualify the investor. Talk to clients/prospects to gauge their level of financial literacy. Try especially to identify their areas of financial insecurity, which education can help to ease.

- Provide education. Based on the qualifying conversation, make a list of literacy items for each investor to address, ideally in person. Keep in mind that a one-size-fits-all approach doesn’t work. The list should refer to the five pillars of literacy.

- Keep it simple and friendly. It’s crucial not only to use plain language and avoid jargon in your educational interactions, but also not to talk down to the investor: Expressing humility and making the investor feel comfortable will help to instill confidence. Keeping it simple can dramatically improve the relationship.

- Ready… Make sure the investor is comfortable with the education you’ve provided and ready to talk more seriously and specifically.

- Set… Prepare the investor for the next conversation, which will focus on needs and solutions. Give the investor a list of agenda items with related questions to address.

- Go! Have the conversation. Both you and the investor will reap the benefits of the financial literacy efforts you’ve made.

Your Thriving

Practice

A destination to empower financial professionals to build, manage, and grow their practice

Get started with Global Atlantic

Take the next step with a company that can help elevate your business.

Need help?

Find all the contact information to submit and service your business.